INVESTMENTS MADE WITH Guidance

You know you need to invest, but you want some help and guidance along the way. Trying to sift through all of the information yourself can feel like drinking from a firehose. We’re here to walk with you along the way and look over your shoulder as an objective third party helping you make the best investment decisions for your goals.

THE POWER OF COMPOUNDING Money

Compounding is the practice of generating earnings from previous earnings. In other words, you receive interest not only on your original investments, but also on any interest, dividends and capital gains that accumulate – so your money can grow faster and faster as time passes. This is particularly evident in retirement accounts, where principal is allowed to grow for years tax-deferred or even tax-free.

CONSIDER THIS SCENARIO:

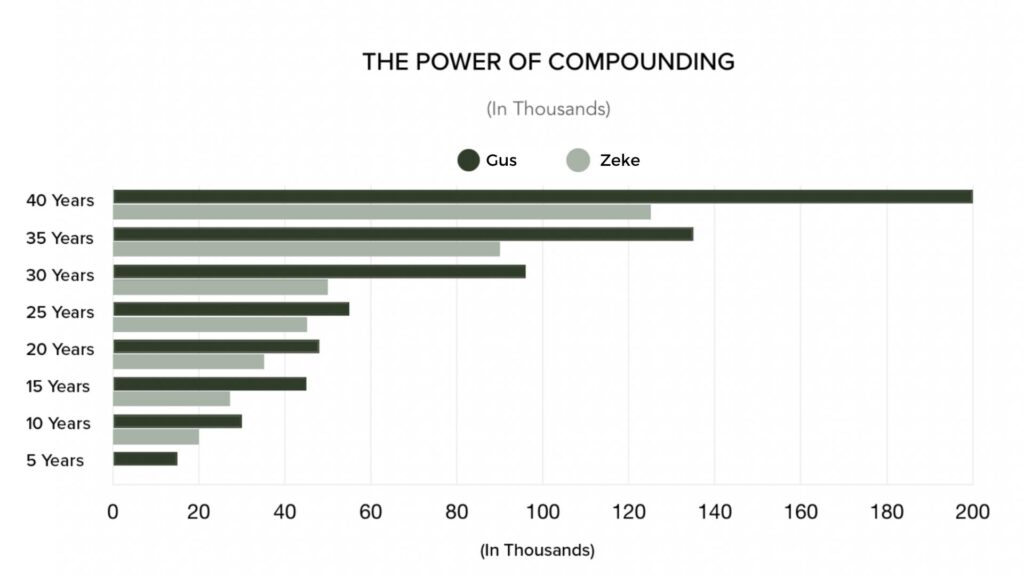

Gus and Zeke, both 24 years old, are hired by the same employer on the same day. After a year of working, Gus begins contributing $1000 a year to his employer’s plan. Zeke, on the other hand, starts contributing $1000 a year after 10 years of working. Gus stops contributing after 15 years, while Zeke continues to invest until he retires at age 65.

They both contributed $1000 a year and earned an 8% rate of return on their investment. Gus contributed a total of $15,000, while Zeke contributed a total of $31,000 – over twice as much as his coworker. However, Gus’s returns remarkably surpassed Zeke’s because of the power of compounding.

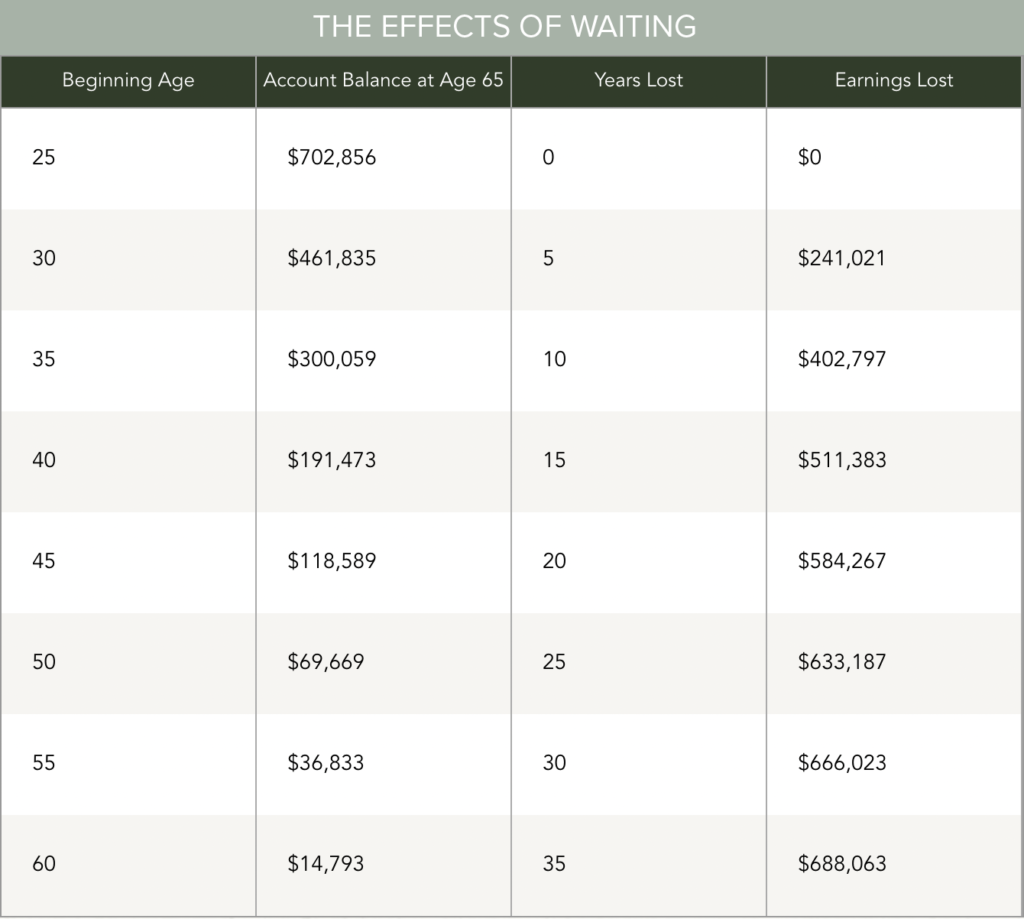

The following chart shows the negative impact that waiting just five years can have on your earning potential (depending on your investment decisions and market conditions).

*The illustration does not reflect specific investments. The returns are hypothetical and do not reflect past or future performance of any specific investment option. Payment of income taxes is not reflected. Systematic investing does not ensure a profit or guarantee against loss. You should consider your financial ability to continue purchases through periods of low price levels.

*This illustration assumes a $200 monthly contribution that earns interest at 8%. It does not reflect the performance of any specific investment. The returns are hypothetical and do not reflect the past or future performance of any specific investment option. Payment of income taxes is not reflected. Systematic investing does not ensure a profit or protect against loss. You should consider your ability to invest consistently in up and down markets.